The quantity traded times the tax equals: is a fundamental economic relationship that explores the interplay between market forces and government policies. By understanding this relationship, economists can analyze economic behavior, forecast market trends, and inform policy decisions.

The concept of quantity traded refers to the number of goods or services exchanged in a market during a specific period. Tax, on the other hand, is a mandatory levy imposed by the government on individuals or businesses, typically as a percentage of income or consumption.

Quantity Traded

Quantity traded refers to the amount of a good or service that is bought and sold in a given market or economy over a specific period. It is a fundamental concept in economics as it reflects the level of economic activity and the efficiency of the market.

Quantity traded is typically measured in units, such as kilograms, gallons, or number of items. It can be used to track changes in consumer demand, production levels, and overall economic growth. By analyzing quantity traded, economists can gain insights into market trends, supply and demand dynamics, and the impact of government policies and external factors.

Factors Influencing Quantity Traded

- Consumer demand

- Price of the good or service

- Availability of substitutes and complements

- Income levels

- Government policies (e.g., taxes, subsidies)

- Economic conditions (e.g., recession, inflation)

Tax

A tax is a mandatory financial charge or levy imposed on a taxpayer (an individual or legal entity) by a government organization in order to fund government spending and public services. Taxes are typically based on income, property, or consumption.

Different types of taxes include income tax, sales tax, property tax, and excise tax. Taxes can have a significant impact on economic activity by influencing consumer spending, business investment, and overall economic growth.

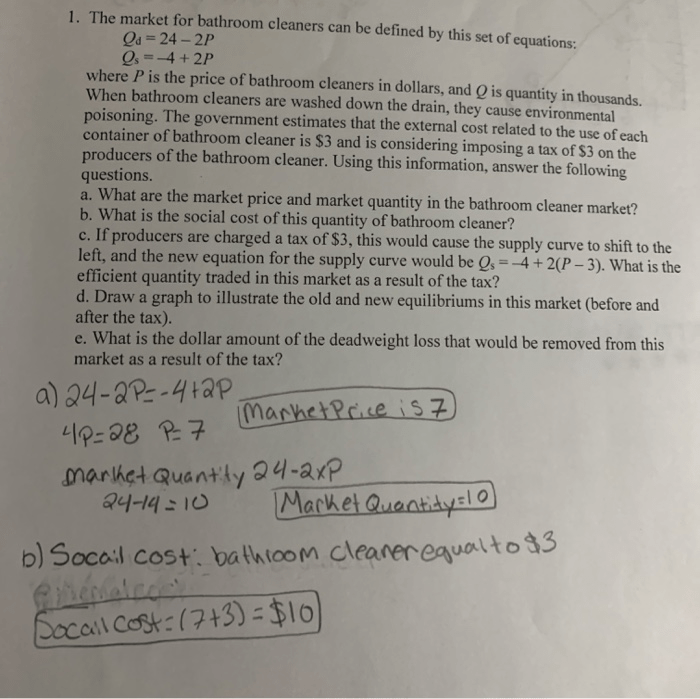

Impact of Taxes on Quantity Traded, The quantity traded times the tax equals:

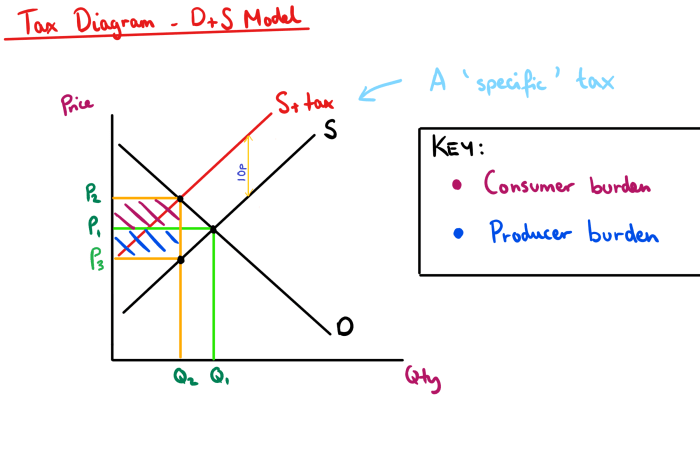

- Taxes can reduce quantity traded by increasing the cost of goods and services.

- Taxes can shift the demand curve to the left, leading to a decrease in quantity traded.

- Taxes can affect the supply of goods and services, potentially leading to changes in quantity traded.

Quantity Traded Times Tax

The quantity traded times the tax is a mathematical relationship that represents the total tax revenue generated from the sale of a particular good or service. It is calculated by multiplying the quantity traded by the tax rate.

This relationship can be used to analyze economic behavior and the impact of taxes on markets. By understanding how changes in quantity traded or tax rates affect tax revenue, policymakers can make informed decisions about fiscal policy.

Hypothetical Scenario

Suppose a good is sold for $10 per unit and a 10% tax is imposed on its sale. If 100 units are sold, the total tax revenue generated is:

“`Quantity traded x Tax rate = Tax revenue

units x 0.10 = $10

“`

Examples and Applications: The Quantity Traded Times The Tax Equals:

The quantity traded times tax relationship has been used in various economic analyses, including:

- Estimating the impact of tax policies on government revenue

- Analyzing the elasticity of demand for goods and services

- Forecasting economic growth and tax revenue projections

However, it is important to note that this relationship may not always be accurate, as it assumes that other factors affecting quantity traded remain constant.

Tax Implications

Taxes can have significant implications for the quantity traded of different goods and services. Higher taxes can lead to decreased demand and lower quantity traded, while lower taxes can have the opposite effect.

Policymakers must carefully consider the potential economic consequences of changing tax rates. By analyzing the quantity traded times tax relationship, they can make informed decisions that balance revenue generation with economic growth and consumer welfare.

FAQ Section

What is the significance of the quantity traded times the tax equals:?

It reveals the combined effect of market demand and tax policies on the volume of goods and services exchanged in a market.

How can this relationship be used for economic forecasting?

By analyzing historical data and incorporating tax policy changes, economists can predict future market trends and anticipate economic outcomes.

What are the potential applications of this relationship in different economic contexts?

It can be applied to analyze the impact of taxes on consumer behavior, business investment, and overall economic growth.